are funeral expenses tax deductible uk

The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible.

Donations Are Tax Deductible All Donors Will Be Entered In A Drawing To Win An Amazon Fire Tablet With 16 Gb In The Color O Special Olympics Olympics Special

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body.

. Thirdly and separately there was a pre-death wake for the carers who cared for the deceased leading up to her death. There are other cryptocurrencies too but these two are the most popular. You may be interested to read Practice note Possession of a deceased body.

However qualified medical expenses incurred prior to the death in an attempt to treat an illness are tax-deductible. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to. What funeral expenses are tax deductible.

Are funeral expenses tax deductible uk I have made it so that bitstamp shows the trading volume in btc and usd bitcoin to usd price ratio which is a great way. From HMRC website. However most estates dont qualify for this deduction unless the estate reaches the threshold of 12060000 the federal estate tax exemption limit in the 2022 tax year.

Ad Help Protect Loved Ones From The Worry And Expense Of Your Funeral With A Funeral Plan. Taxpayers are asked to provide a breakdown of the. You may also deduct the cost of a headstone or tombstone marking the site of the deceaseds grave.

Many estates do not actually use this deduction since most estates are less than the amount that is taxable. What Funeral Expenses Are Tax Deductible. The taxes are not deductible as an individual only as an estate.

If the funeral is paid for by a family member or another benefactor the estate loses the deduction. Funeral expenses are included in box 81 of the IHT400. You may allow a deduction as a funeral expense for reasonable costs incurred for mourning for the family.

Necessary expenses paid by the executor or administrator when arranging the funeral. You can deduct funeral expenses from the value of the estate plus a reasonable amount for mourning expenses. The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying.

There are a few exceptions though including final medical expenses and costs incurred by the decedents estate. These wake costs total around 900. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim them.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. People who are paying taxes on individual income cant deduct funeral expenses. Question Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

Has anyone had any experience of successfailure in claiming the above or similar expenses against death IHT. This means the cost is deductible from the assets within the estate. It seems that these costs were incurred in the week leading up to the funeral.

Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Get A 120 MS Gift Card When You Buy A Funeral Plan By 15 July 2022. Furthermore funeral expenses are deductible for Inheritance Tax purposes. Flowers refreshments provided for the mourners after the service necessary expenses incurred by the executor or.

You may deduct funeral costs and reasonable mourning expenses. The cost of mining bitcoin is dependent on a few factors. Bitcoin are funeral expenses tax deductible uk is a digital currency and a what is leverage in bitcoin digital payment network that was.

You will need to consider what is reasonable on a case by case basis. Claim any funeral expenses paid for by the estate. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs.

Funeral expenses which explains that funeral expenses are payable from the estate provided that they are reasonable or authorised by the will and that a deduction for inheritance tax IHT is allowed for reasonable funeral expenses. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses.

The estate must pay for all these costs which can then be deducted from the estate taxes. If you ask any mortgage professional they will say yes. Do not claim this deduction on your individual tax return.

Deducting funeral expenses as part of an estate. Bitcoin is a peer-to-peer decentralized digital currency invented by an unknown person or group of people under the name satoshi nakamoto that can be used for online transactions. HiIf a limited company has an employee die whilst working for them in an accidentAnd they volunteer to pay the funeral expenses.

Refreshments for mourners. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. This money is paid out before the beneficiaries receive their inheritance.

These expenses may also include a reasonable amount to cover the cost of. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. Either way the cost of a funeral is known as a testamentary expense.

Expenses can include a reasonable amount to cover the cost of. The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs.

While individuals cannot deduct funeral expenses eligible estates may be able to claim.

Utilize Tax Free Covid 19 Reimbursements For You And Your Staff Dental Economics

Travel Itinerary Template Word Best Of Granny Joan S Hitek Lady Blog Using Google D Travel Itinerary Template Vacation Planner Template Travel Planner Template

Are Funeral Expenses Tax Deductible

Itemized Vs Standard Deduction What Are The Main Differences Marca

Are Funeral Expenses Tax Deductible

What Is Esi Registration Funeral Expenses Retirement Fund Goods And Services

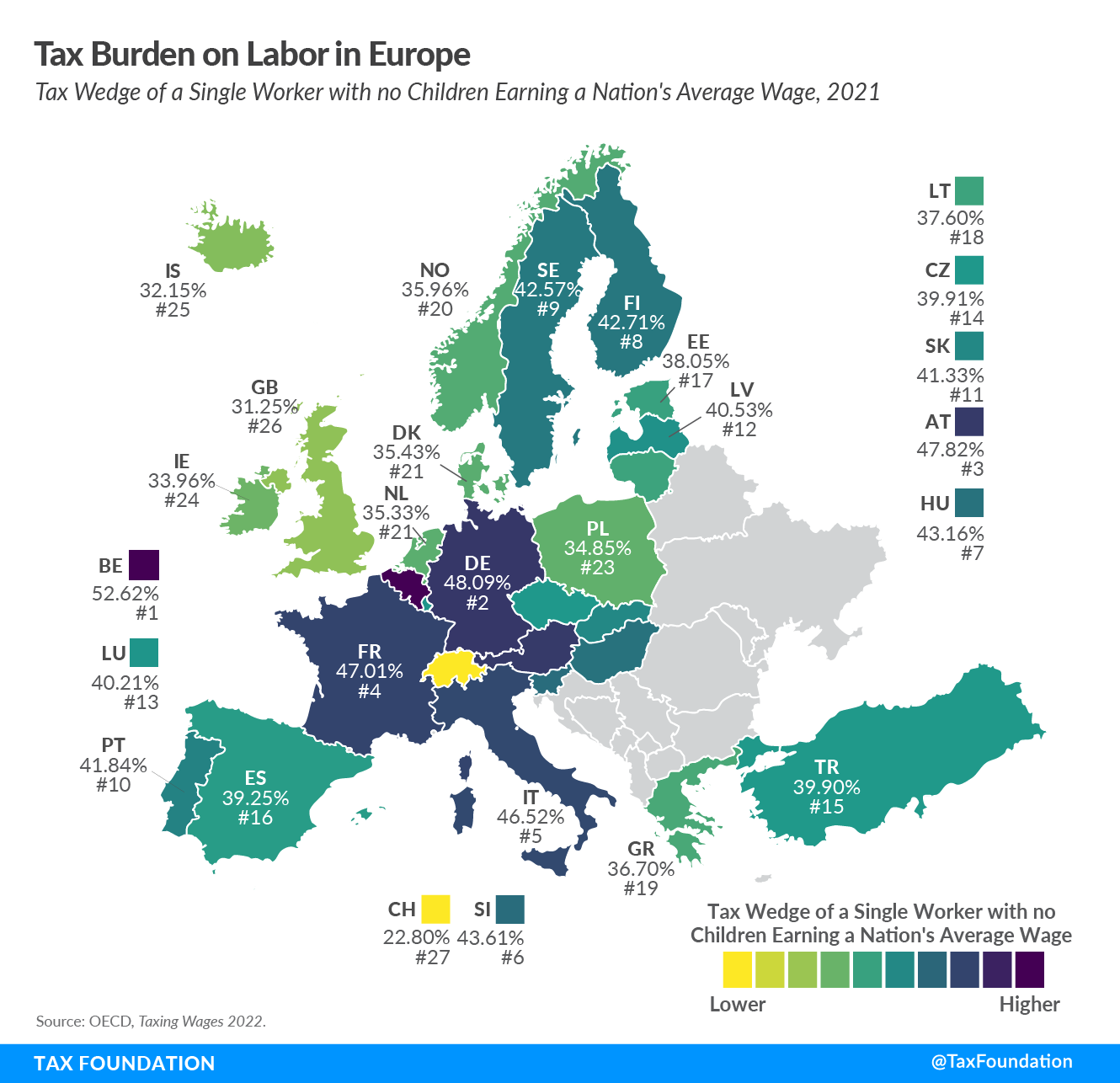

Poland Tax Income Taxes In Poland Tax Foundation

What Is A Tax Deduction Tax Deductions Deduction Tax

Sars Tax Deductible Business Expenses Listed Deductions

Best Gst Registration At Kolkata Business Insurance Limited Liability Partnership Liability Insurance

Is Life Insurance Taxable In Canada Moneysense

Do You Have To Report 401k On Tax Return It Depends

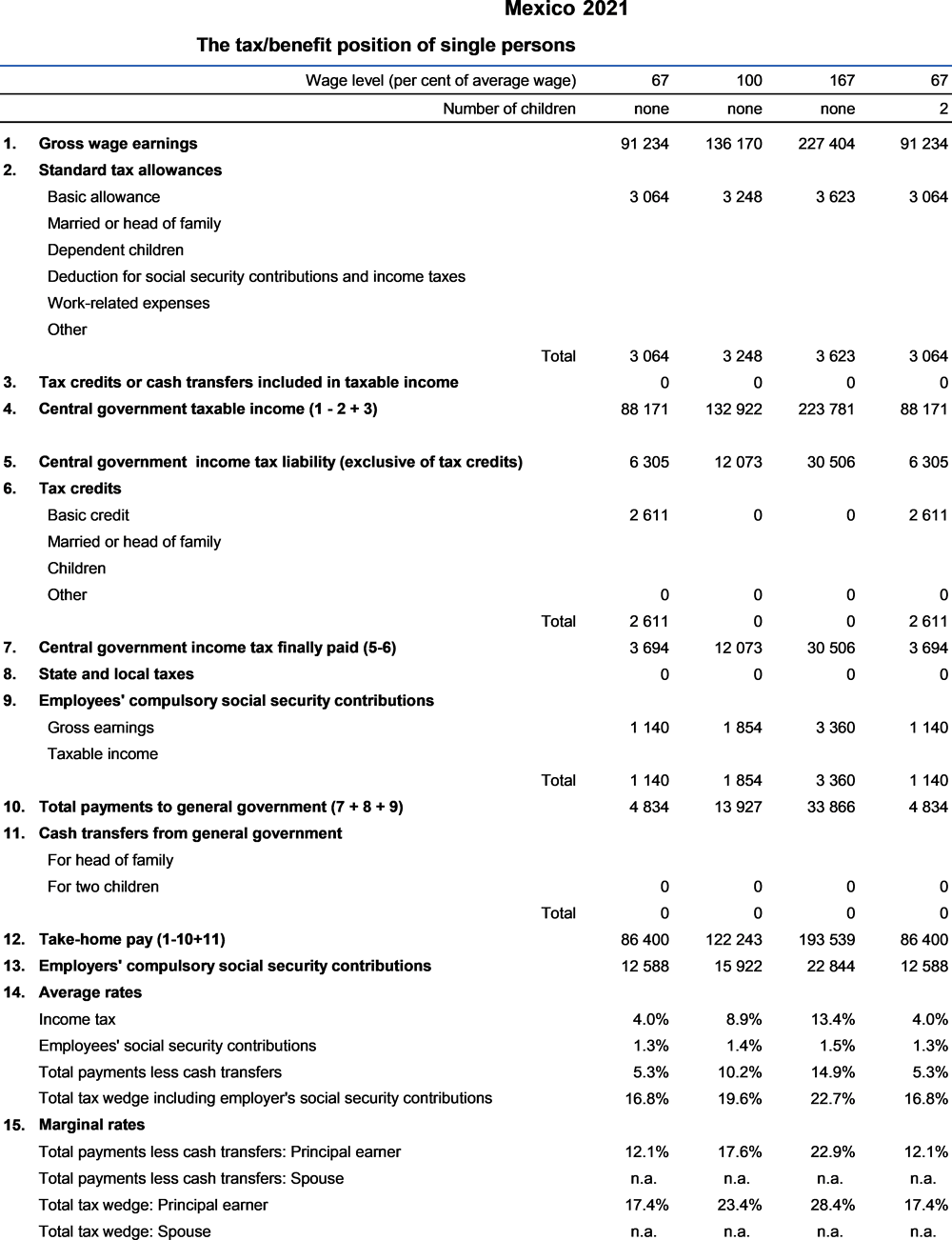

Mexico Taxing Wages 2022 Impact Of Covid 19 On The Tax Wedge In Oecd Countries Oecd Ilibrary

Tax Information Every Musician Should Know Diy Musician

Are Funeral Expenses Tax Deductible Pagegoo

:max_bytes(150000):strip_icc()/the-concept-of-tax-settlement--912303164-28c2a4fb3bcf4656b57b44532247f9c6.jpg)